I’m super excited…

After weeks of waiting, penny stocks are on fire!

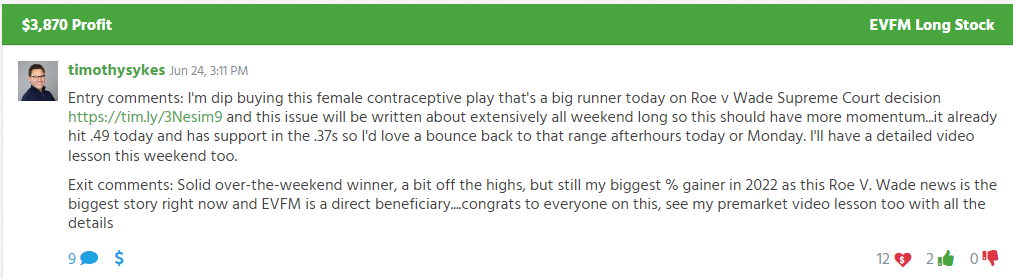

This past weekend, I grabbed a swing trade that netted me over $3,870 IN PROFITS.

Check out all my trades at profit.ly

I was so pumped I got up at 5:00 a.m. to film a recap for my students.

What I loved about this setup was how simple and straightforward it was.

Normally, I’d reserve this kind of content for my paid members.

But I’m going to give you a sneak peek behind the curtains.

Because once you know what to look for, you’ll be able to spot stocks with massive potential.

The Setup

This trade relied on two components: news and price action.

Last week’s Supreme Court decision to overturn Roe v. Wade sent ripples through markets.

Our Breaking News Team was all over the story, hitting members with headlines on stocks tied to the story…

One of which is Evofem Biosciences Inc. (NASDAQ: EVFM).

The company provides hormone-free contraceptives and STI prevention.

This stock caught my eye because of Friday’s price action.

Even in this one-minute chart, you can see shares rise on volume that is substantially higher than the previous day.

In fact, if you look at the daily chart for the stock, the volume stands out even more.

A great way to search for stocks like these is with a scanner or stock screener.

In our StocksToTrade platform, I use the screener to look for stocks with volume well above its average.

Plus, I can also narrow down my search by the float and other items.

My thesis for the trade was simple. I expected folks to read more and more about the fallout from the court’s decision over the weekend.

Ideally, they would start moving money early Monday.

Execution

Going back to the one-minute chart, I was looking for support around $0.37-$0.38.

You can see in the chart how shares used that as a pivot, initially finding resistance there on the way up, and then using it as support on the way down.

Now, I wasn’t happy to see the stock slide as it moved into the close. That isn’t the type of price action I like to see.

But, given the type of trade this was, I knew that I needed to give it a little more slack than I typically do.

However, I also sized my trade accordingly.

In this trade, I bought 15,000 shares at $0.392 for a total position size of $5,880.

For my day trades, I may go with something closer to $10,000.

Swing trades often carry more risk because they can move so much overnight or over the weekend.

I choose how much I want to put into each trade based on the potential range I see as well as where my entry is compared to a stop.

If you go back and look at EVFM over the last few weeks, you’ll notice that it’s been trading around $0.30.

That was the worst case scenario. But I expected that even if the stock flopped, I’d still have a shot at getting out for a loss of just a few pennies.

Yet, the upside potential on this one seemed enormous.

Had I actually held onto shares for a few more hours, I could’ve possibly picked up as much as another $6,000!

Now, I’m perfectly happy with the gains I made.

If I wanted to work for more, I could’ve sold half near the open, set a worst-case stop back at my entry, and tried to scale out of the position if and when it broke higher.

One last thing I want to point out.

I didn’t enter this stock on the highs. I waited until it pulled back into support.

This is a big part of how I manage risk, keeping my losers small and winners large.

Final Thoughts

All any trader needs is a simple setup that combines price action and news.

Don’t focus on trying to catch every single play out there.

Become an expert on just one pattern.

I recommend my Supernova pattern.

This is one of the easiest setups to spot and helped me earn my first $1 million trading.

Plus, it works on any stock from OTC micro-caps to Tesla.

Click here to learn more about my Supernova pattern.

—Tim

The post Breaking Down My 65%+ Swing Trade appeared first on Timothy Sykes.