“When do I sell?” is easily the most-asked question I’ve received over the years. There are multiple answers to this question based on certain variables. The first key variable is whether you’re a day trader, short-term swing trader, or long-term buy and holder. I prefer swing trading, so my answer many times is when corroborating technical evidence tells me to sell.

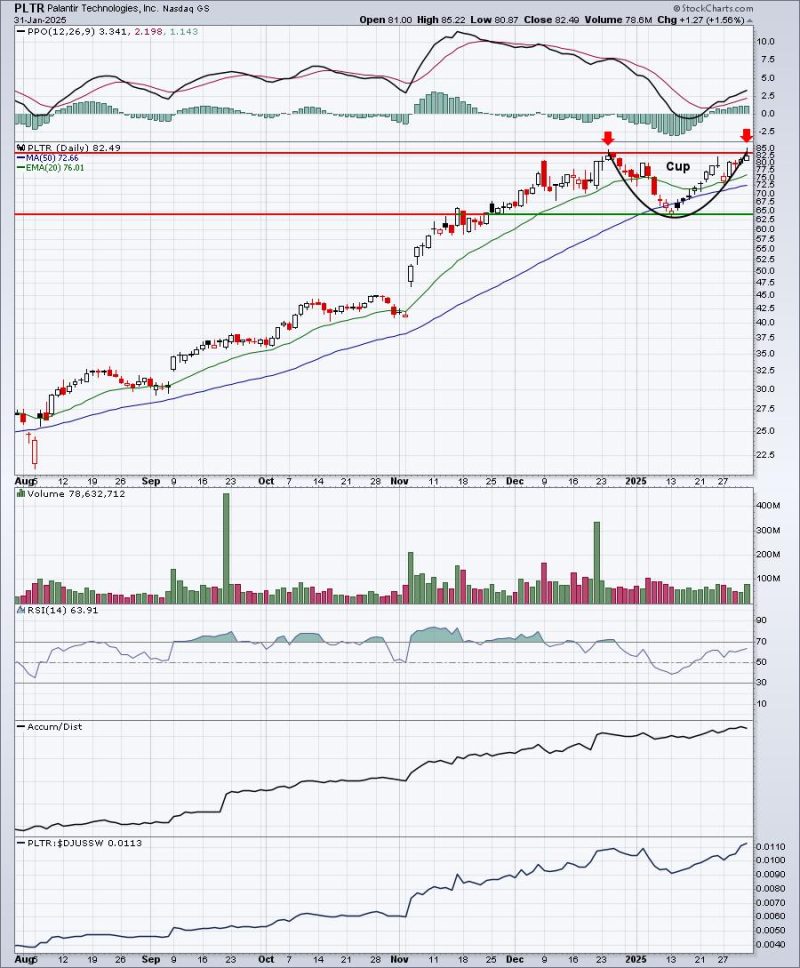

My easiest sell is after a failed attempt at a breakout or a major reversing candle on heavy volume. The first one is fairly easy to see. Let’s use Palantir Technologies, Inc. (PLTR) as an example from Friday. I don’t know if PLTR is going up on Monday or later this week, but what I do know is it broke out to an intraday all-time high on Friday, then failed to hold that breakout on a closing basis. Check this out:

First, let me say that PLTR has a very strong chart. The AD line is continuously rising, a bullish cup has formed, and PLTR is a leader amongst software stocks ($DJUSSW). Second, I’m not saying PLTR is a short candidate. I’m simply saying it would be a sell for me short-term to take profits. I rarely short during secular bull markets. If it does make the breakout, I can always decide to jump back in. But I’d be looking for PLTR to pull back to form a handle off the cup pattern, or possibly even pull back to the recent low near 65. Sideways consolidation is a very real possibility after an extended advance like the one PLTR has enjoyed. If you need further evidence, look no further than NVIDIA Corp (NVDA) after its June/November/January tops. It’s still consolidating.

The two red arrows mark what “could” be a double top, resulting in a lengthy period of selling and/or consolidation. Taking profits now is a risk-management strategy, eliminating the possibility of riding PLTR back to the downside. If income taxes is a concern and you’re a long-term investor, I see nothing to suggest PLTR is a sell here. I’m only discussing my preferred short-term swing trading strategy.

A second stock with a similar look would be Parker Hannifin Corp (PH), which surged on Thursday after its earnings report. PH then tacked on further gains on Friday and found itself intraday in all-time-high territory. It too looks like a cup has formed:

The AD line here doesn’t seem quite as strong as PLTR, but PH clearly is a leader in the industrial machinery space ($DJUSFE). As I looked around the market on Friday, and really throughout the week, I couldn’t help but see a TON of companies testing key overhead price resistance.

The S&P 500 filled its gap from the severe drop on Monday morning, then printed a bearish engulfing candle on Friday:

Seeing the S&P 500 fail at all-time highs and gap resistance, with well-above-average volume makes me very nervous, especially given the overall market environment.

You’re Invited!

There are a number of bearish signals emerging that I want to discuss with our entire EarningsBeats.com community. Accordingly, we’ll be hosting a FREE webinar on Monday, February 3rd at 5:30pm ET. There’s no credit card required, but you do need to register with your name and email address. CLICK HERE for more information.

Happy trading!

Tom