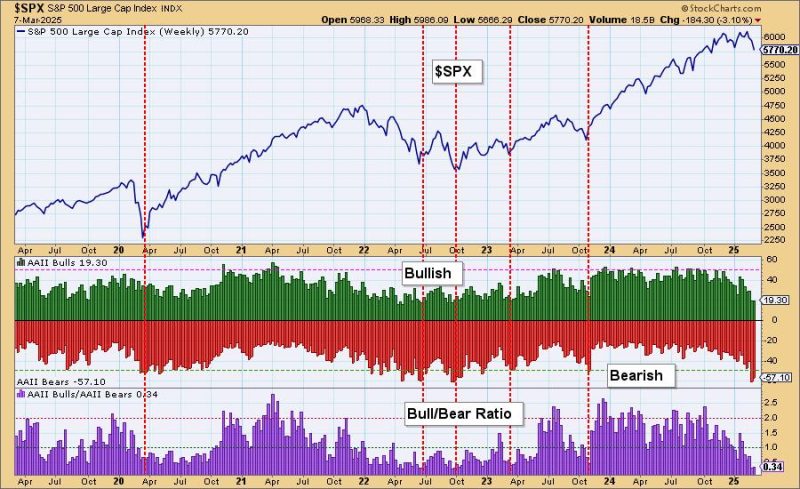

One thing to understand about sentiment measures is that they are contrarian. If investors are too bullish or too bearish, everyone has jumped on the bandwagon and now it is time for the wheels to fall off. Right now we are seeing extraordinarily bearish sentiment coming out of the American Association of Individual Investors (AAII).

We have well over 50% of participants bearish on the market. As you can see that is a comparatively high reading, something we don’t see very often. This has brought the Bull/Bear Ratio down to 0.34! That is extremely low!

What does this mean? It means we may be arriving at an inflection point. You can see from past readings how the market does tend to turn back up when sentiment gets too bearish. Could this be what is setting up after the big declines that we’ve seen on the major indexes?

We do think that we’ll see some upside next week after Friday’s comeback rally and the fact that price is now sitting on important support and reversing. However, we don’t think that this pullback, almost correction, is over. There is still too much confusion and uncertainty over tariff talks and geopolitical concerns. The market hates uncertainty.

Conclusion: We have bearish extremes being hit on the AAII sentiment chart that does imply that we could see an upcoming rally. However, we don’t believe it will amount to much given the overall geopolitical environment. The market is still highly overvalued and that is a problem too.

The DP Alert: Your First Stop to a Great Trade!

Before you trade any stock or ETF, you need to know the trend and condition of the market. The DP Alert gives you all you need to know with an executive summary of the market’s current trend and condition. It not only covers the market! We look at Bitcoin, Yields, Bonds, Gold, the Dollar, Gold Miners and Crude Oil! Only $50/month! Or, use our free trial to try it out for two weeks using coupon code: DPTRIAL2. Click HERE to subscribe NOW!

Learn more about DecisionPoint.com:

Watch the latest episode of the DecisionPointTrading Room on DP’s YouTube channel here!

Try us out for two weeks with a trial subscription!

Use coupon code: DPTRIAL2 Subscribe HERE!

Technical Analysis is a windsock, not a crystal ball. –Carl Swenlin

(c) Copyright 2025 DecisionPoint.com

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.

DecisionPoint is not a registered investment advisor. Investment and trading decisions are solely your responsibility. DecisionPoint newsletters, blogs or website materials should NOT be interpreted as a recommendation or solicitation to buy or sell any security or to take any specific action.

Helpful DecisionPoint Links:

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)