Hey trader. Tim here.

Despite the free-fall in stocks…

There are still monster plays to be made if you’re patient and know where to look.

Today I want to cover one of my favorite setups I used to snap up some nice profits in Sysorex Inc. (OTC: SYSX).

I managed to get in and out within the first 15-minutes of the trading day!

Sure, $429 in trading profits might not sound like a lot of money, but the trade lasted a quick 15 minutes.

And I’m not bringing it up to brag. I truly believe this setup is super simple to learn and easy to execute.

That’s why I want to share the ins and outs of this trade with you. Because if you’re able to spot it, you can start applying this strategy to make money in the market.

A Watchlist Wonder

Most of my trade ideas come from three sources…

First, the news. And there’s no better place for this than the Breaking News Chat feature in our StocksToTrade Platform.

Our analysts sift through the news to curate timely, actionable content.

This past Monday, for example, they alerted members to Catalyst Biosciences Inc. (NASDAQ: CBIO) at 8:30 a.m.

Breaking News Members saw the post well before the stock took another leg higher.

The second place I look for trade setups is my trusty stock screener.

I have one set up in StocksToTrade that looks for the type of low-float equities I like to play with.

Plus, I can line this up with the Oracle feature in the platform that calculates support and resistance levels.

Get a 14-Day trial of StocksToTrade platform for as little as $7.

The last place I look for trading opportunities is my trusty watchlist.

It just so happens that I’ve had my eye on SYSX for a few weeks now. In fact, I picked up a couple of trades before Tuesday.

The Setup

Let’s dig into the details, shall we?

This is a 1-minute chart of SYSX.

One of the key concepts I teach my students is the ‘morning panic.’

In the morning panic, a typically bullish stock takes a quick dive on lighter volume.

What I look for here is a break of an important level followed by a quick reversal in the other direction on volume.

Here, the stock rallied for a few minutes out of the gate.

Then, as volume slowed, it made a top in one candle where the price went nowhere (yet saw heavy volume).

From there, shares slid past the open.

That’s a key break that should trip a handful of stop orders.

The next two candles were red, where the close was lower than the open.

However, it was in the next 1-minute candle that I entered the trade, looking to see follow-through that moved above the opening print.

Shares didn’t disappoint as they pushed higher before trading sideways.

It was at that point I decided to cut the trade loose.

Why did I do that?

For starters, the volume essentially died out. That left me at the mercy of whichever side decided to hit the stock next, longs or shorts.

That’s a coin flip … Not something I want to leave to chance when I’m already at a decent profit.

Second, and more importantly, if the stock was going to head higher, it would have already done so on heavy volume.

The fact that it hit a certain price and just died told me that the run, at least for the time, was over.

But there was also a much bigger reason I wanted out.

You see, at the same time as SYSX stalled, the broader stock market was making new lows on the day.

While penny stocks can and do trade independently of the major indexes, they’re still susceptible to general market pressure.

And when I’ve already made a profit, there’s no reason to let the trade reverse on me.

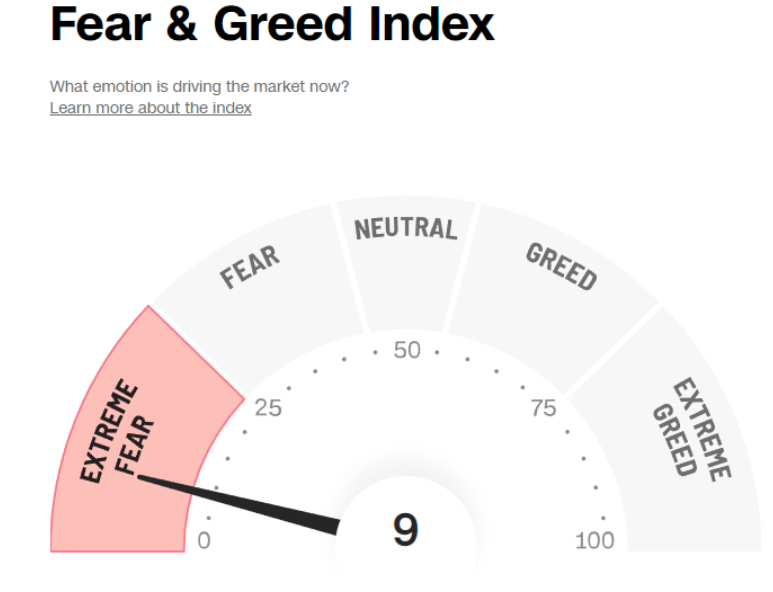

This market isn’t the same as it was in 2020 or 2021. We aren’t seeing the massive gains with huge follow-through that would send meme stocks into the stratosphere.

Right now, risk is coming out of the market, creating downward pressure on small caps and penny stocks.

Key Takeaways

So, let’s review the components of this trade:

- Identify a stock from the watchlist, screener, or news

- Look for breaks of important price levels during the morning panic

- Wait for a reversal candle

- Use that as a catalyst for a long trade back towards if not above the break level

- Take profits when the stock starts to trade sideways

Now, this is just one example of the setups I like to work with.

But my favorite? Well, you’ll just have to see … Click here.

—TIM

The post Breaking Down $SYSX appeared first on Timothy Sykes.