One of the main reasons why traders can’t make money in the market is shiny object syndrome.

Their tendency to constantly chase new trends, opportunities, and ideas, causes them to have insane levels of distraction, stress, a lack of focus, and a sense of being overwhelmed.

For example, trying to figure out when the perfect time to buy or sell a stock is…

It’s a rabbit hole I’ve gone down before.

And let me tell you, it’s a complete waste of time.

Why?

Because what works in some situations won’t work in another.

So instead of trying to find definitive answers, I developed frameworks.

It’s how I’ve amassed over $7 million in career trading profits, and have helped 20+ traders achieve millionaire trader status.

One of the frameworks I use to find areas of support and resistance is Round Numbers.

It turns out this simple concept works for everything, whether you trade penny stocks or large caps.

And it works especially well when a stock is free-falling.

By using the Round Numbers framework I’m able to put together trades that give me a distinct edge, improve my odds of making money, and set me up for success.

I’m about to show you how it works, and how you can start implementing it to your trading right away.

The Purpose of Round Numbers

When I first discovered the power of round numbers, I thought to myself … There’s no way this is real.

It just seemed so ridiculously simple that I couldn’t fathom this actually being a thing.

But the more I thought about it, the more it made sense.

After looking at my own trading, I realized that I USED round numbers all the time for entries and exits.

Retail traders often do this just because it’s easier.

And believe it or not, so do major institutions.

That doesn’t mean that just because a number is round that it will automatically provide support or resistance to a stock.

That’s where analyzing price action comes in.

One of the stock’s I recently traded, Urban One, Inc. (NASDAQ: UONE) provides a perfect example.

Applying to Urban One

I want to start off by saying that I didn’t trade this correctly. Even though I walked away with a small profit, I missed the main opportunity you’ll see below.

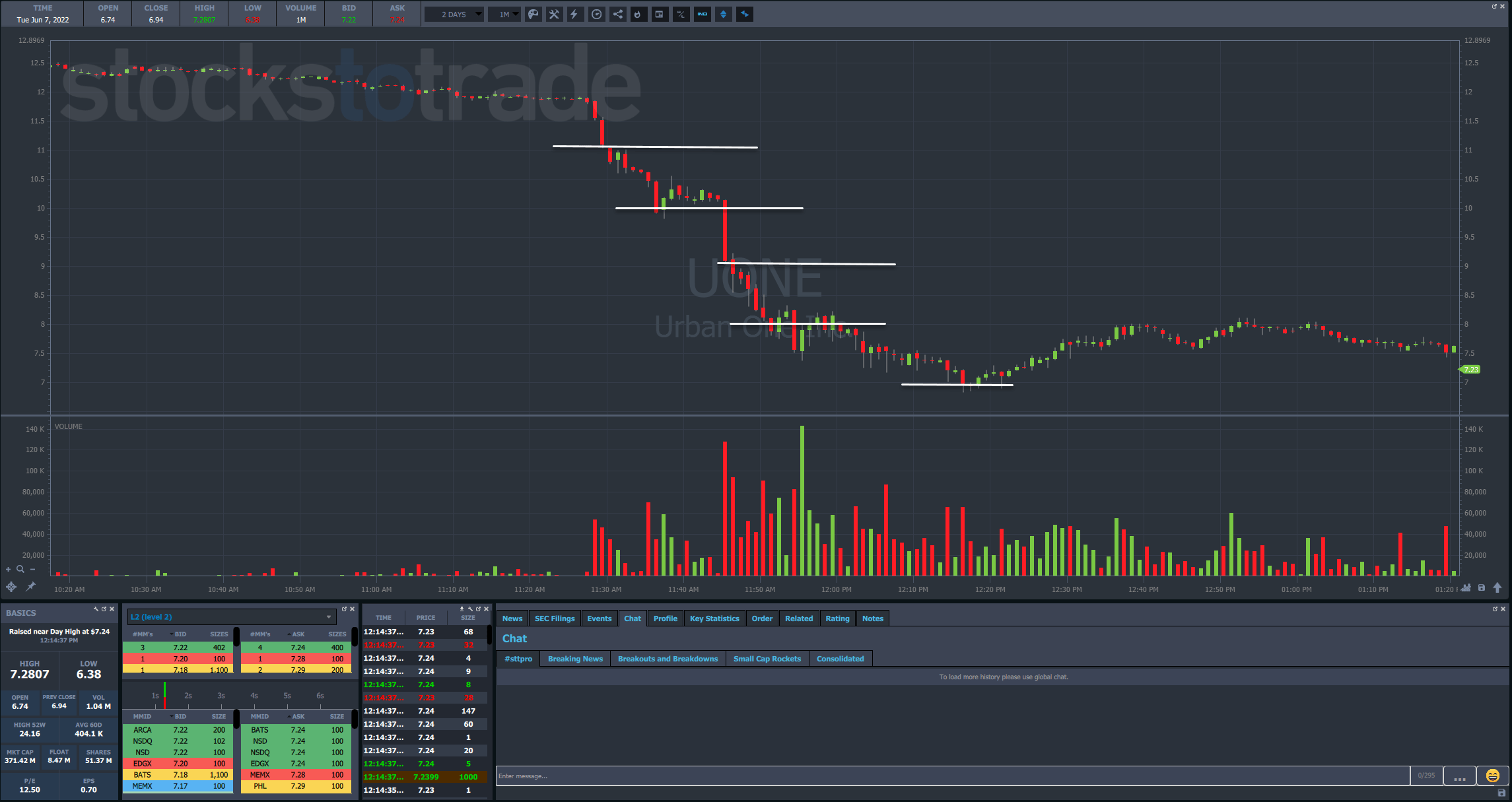

Now, just before 11:30 a.m., shares of Urban One began to plunge on heavy volume.

This sent the stock crashing through multiple levels that I want to analyze individually.

First up was $11. What I want to point out is that the stock pushed through that price pretty easily and almost got down to $10.50. Neither of the two candles after the break managed to rally back above $11. That’s how I knew $11 wasn’t a good support.

Next was $10. Here, the stock did manage to pause for a few minutes.

Now, this wasn’t the spot where I took my position, but it would have been a valid spot as price held the $10 round number. In fact, it got as high as $10.50 on a bounce. However, I would have wanted to see heavier volume to confirm this was a support level.

Next, the stock pushed through $9 without stopping. So, that wasn’t one I needed to look at.

Then, we got down to $8.

Again, you can see how the stock offered a bit of a bounce here. Yet, volume was somewhat tepid, and didn’t see that real spike until a couple of canldesticks later when price dropped down to $7.50.

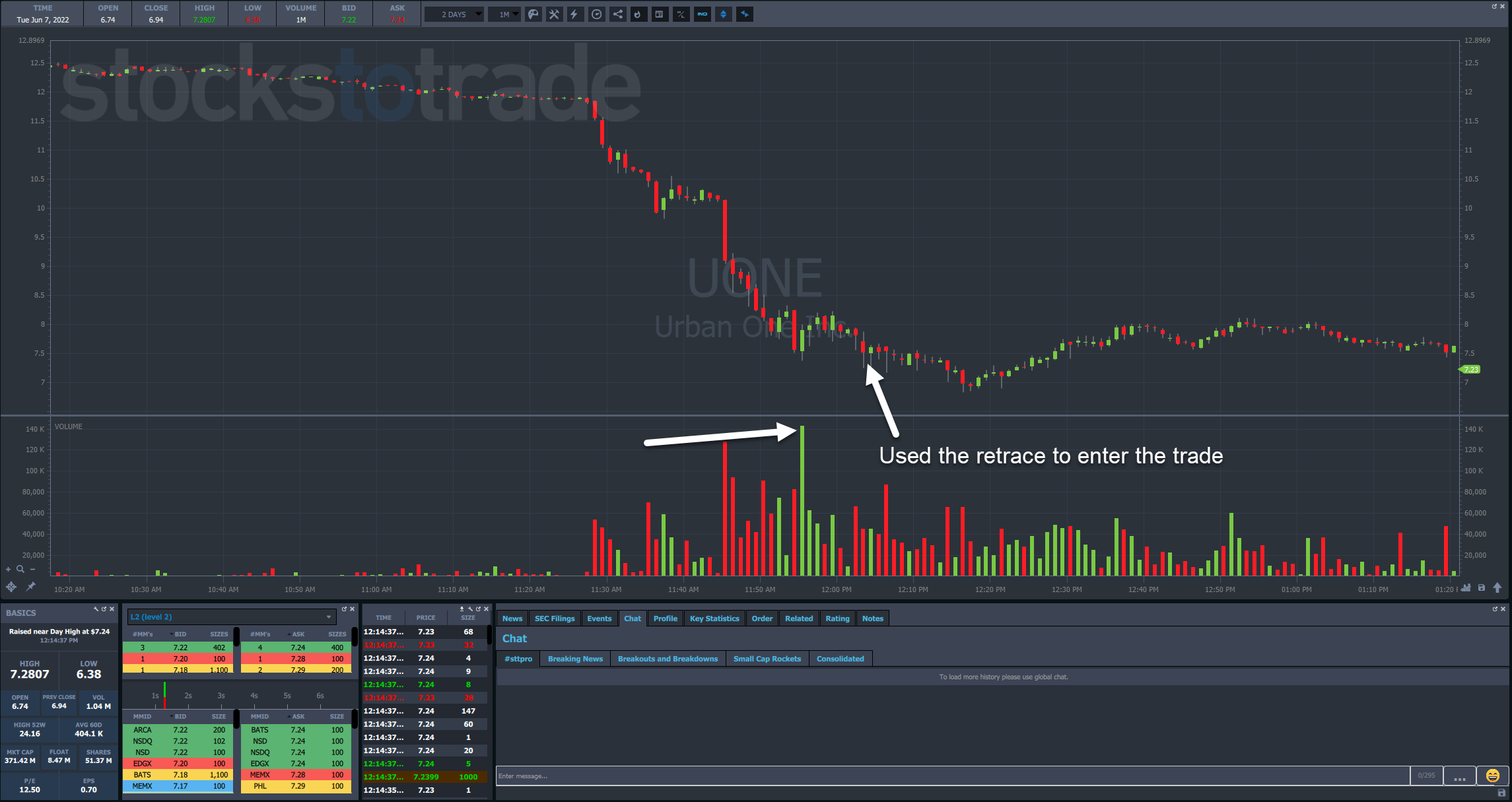

Using that as my base, I entered the stock a bit later when it retraced against that low, breaking it by a slight bit.

Now, I had expected the stock to bounce at that point. Yet, it didn’t really do much in either direction.

So, I cut it loose for a small profit.

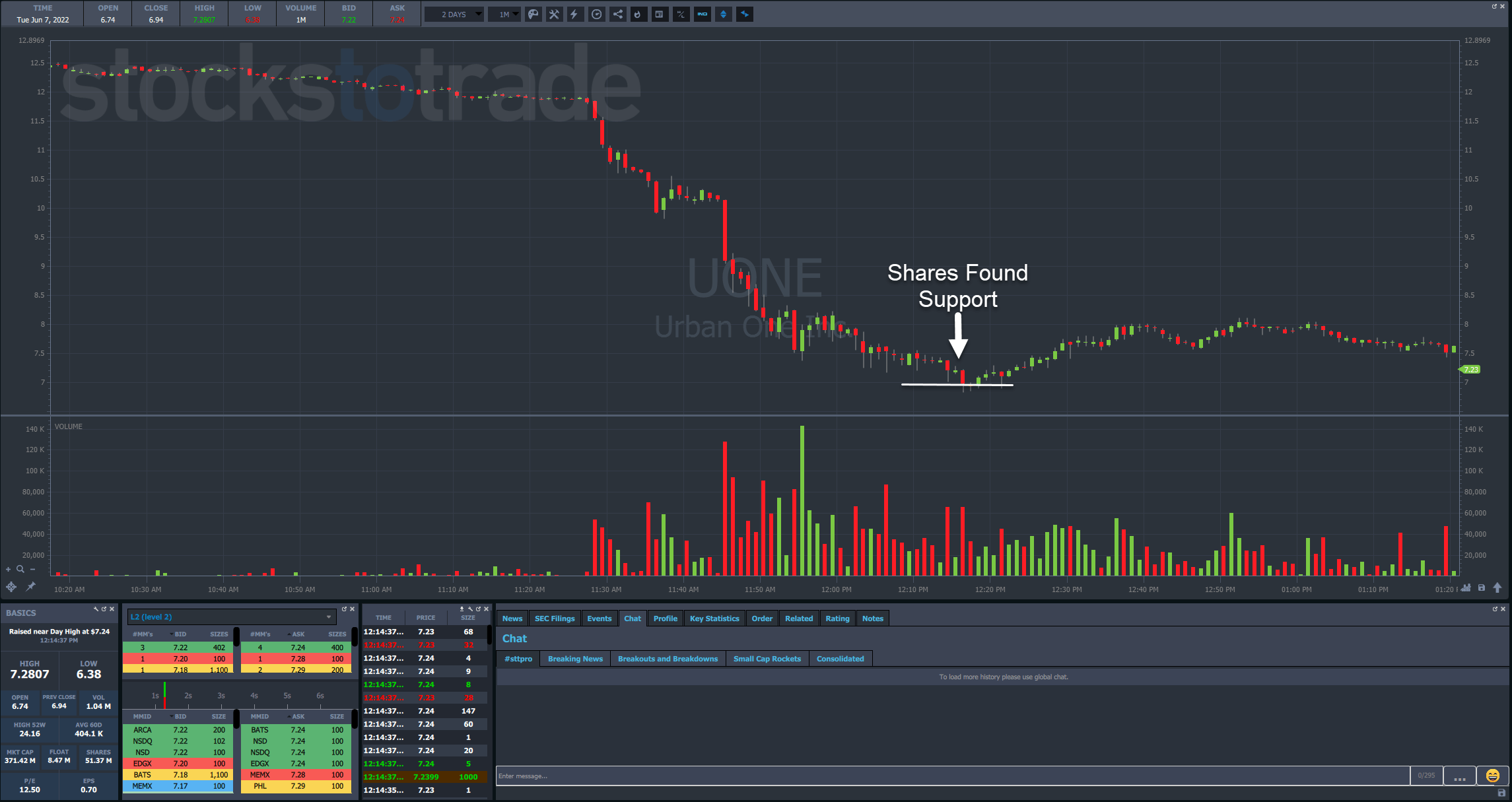

However, the important information came about 20 minutes later.

Here’s where the stock found support at $7.

Normally, I like to see a stock hit and reverse with heavy volume.

However, the fact that a stock down so much could barely break through that $7 mark says to me the selling pressure was weak.

While any heavy increase in volume could have pushed it lower, the likelihood of that happening late in the day wasn’t high.

That’s why a smarter move for me would’ve been to take the trade against $7, even if I let it bounce a bit and got in between $7.10 and $7.25.

The stock had a nice, buoyant feel that ultimately pushed it back up towards $8, another round number.

Final Thoughts

Take some time to look through different charts and how they react to round numbers.

The bigger and rounder the number, the better.

See if you can craft a strategy using those numbers.

Once you learn the power of these numbers, you’ll be ready to take my millionaire challenge.

—Tim

The post Real Support Happens at These Prices appeared first on Timothy Sykes.